You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Do you want to discuss boring politics? (27 Viewers)

- Thread starter mrtrench

- Start date

Brighton Sky Blue

Well-Known Member

From 2015-2017 he was saying all the things I wanted to hear from a Labour politician. After that he nosedived.To think some people actually voted for him.

Earlsdon_Skyblue1

Well-Known Member

From 2015-2017 he was saying all the things I wanted to hear from a Labour politician. After that he nosedived.

Fair enough. I always thought he was a lunatic!

shmmeee

Well-Known Member

Fair enough. I always thought he was a lunatic!

Domestically he’s a fairly normal leftie. On foreign policy he’s a batshit useful idiot of Russia and their allies.

MalcSB

Well-Known Member

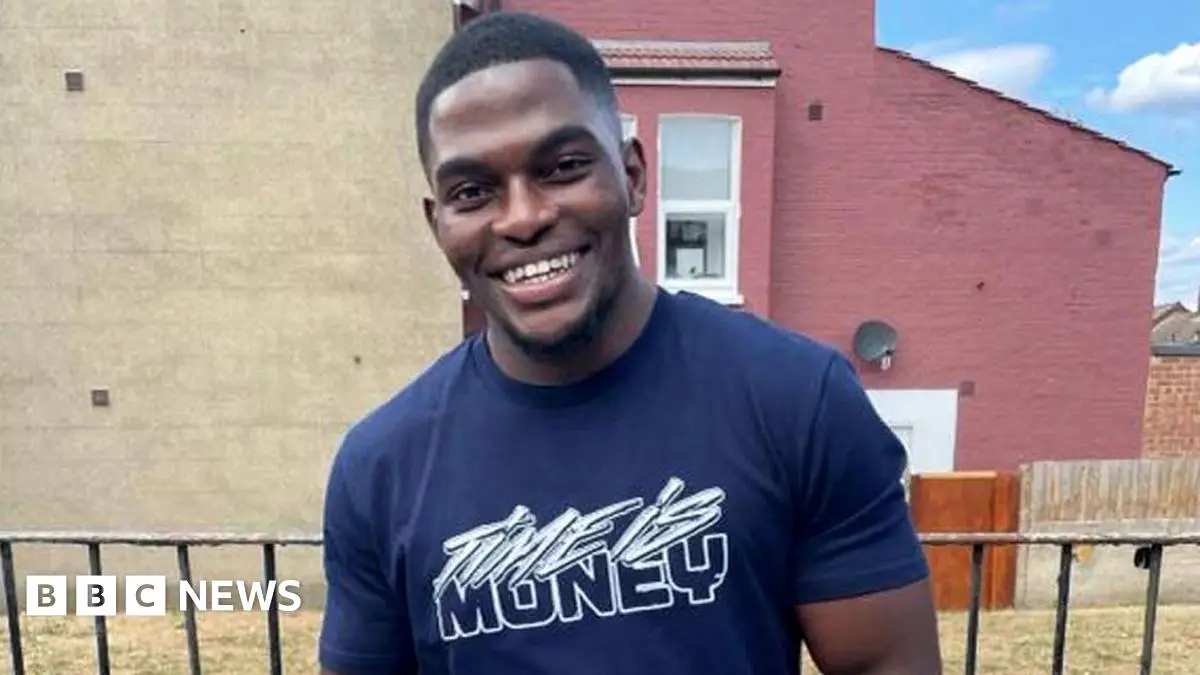

Kaba should have emulated Corbyn in putting his hands above his head.

Chris Kaba shot man in nightclub days before his death

Judge rules details of Chris Kaba’s background can be reported after officer cleared of his murder.

Do that’s why he didn’t surrender,

shmmeee

Well-Known Member

When are the BOE going to speak, usually get a clue about middle of the month don't we? Get in line with the others FFS!

7th Nov is their next meeting apparently.

So they miss October completely, bastard's! Unless it's to actually make the announcement!7th Nov is their next meeting apparently.

MalcSB

Well-Known Member

What’s the fixation with the BoE?When are the BOE going to speak, usually get a clue about middle of the month don't we? Get in line with the others FFS!

MalcSB

Well-Known Member

Probably want to see what disaster befalls the markets after the budget on 30th October.So they miss October completely, bastard's! Unless it's to actually make the announcement!

Quite simply the rate they normally go around middle of month,if we were exporting it's currently high compared to the other rates out there?What’s the fixation with the BoE?

MalcSB

Well-Known Member

But why are you so fixated about BoE rate? Do you have a regular wager On it? Do you hope it will go down so that mortgages are cheaper and house prices will increase?Quite simply the rate they normally go around middle of month,if we were exporting it's currently high compared to the other rates out there?

shmmeee

Well-Known Member

What's the deal with the pensions? Are they planning to start taking some from my employers contribution?

Rumour is about cutting the tax free lump sum you can take out I think.

MalcSB

Well-Known Member

Another one is putting NI on employer’s contributions. Additional cost to employers so the thinking is they may reduce the amount they contribute leading to lower pensions. Gordon Brown mk 2.Rumour is about cutting the tax free lump sum you can take out I think.

Could lead to reduction in jobs or increased prices for goods and services.

I have read that cutting the lump sum could be challenged legally, people would have made long term decisions based on the expected lump sum - e.g. paying off mortgages.

shmmeee

Well-Known Member

Another one is putting NI on employer’s contributions. Additional cost to employers so the thinking is they may reduce the amount they contribute leading to lower pensions. Gordon Brown mk 2.

Could lead to reduction in jobs or increased prices for goods and services.

I have read that cutting the lump sum could be challenged legally, people would have made long term decisions based on the expected lump sum - e.g. paying off mortgages.

Don’t we have some of the lowest employer contribution levels in Europe? I’d reverse the NI cut but they’ve backed themselves into a corner on tax.

The oppo new what they were doing with that oneDon’t we have some of the lowest employer contribution levels in Europe? I’d reverse the NI cut but they’ve backed themselves into a corner on tax.

MalcSB

Well-Known Member

They certainly did, especially as it had increased to contribute to changes to social care cap which Labour have now dropped - another attack on pensioners.The oppo new what they were doing with that one

shmmeee

Well-Known Member

They certainly did, especially as it had increased to contribute to changes to social care cap which Labour have now dropped - another attack on pensioners.

That would be the cap they delayed for a decade then planned for after they left office?

I think it falls in same bucket as the NI cuts TBH. Just more vandalism.

Care needs fixing though. It’s destroying poor councils, some spending upwards of three quarters of their budget on care alone. It’s devastating families and driving immigration. Sadly the best we’ve heard so far is another “commission”, so nothing.

Or

??? how do we figure that out?They certainly did, especially as it had increased to contribute to changes to social care cap which Labour have now dropped - another attack on pensioners.

MalcSB

Well-Known Member

I imagine at the time that they hoped somewhere in the dim recesses of their mind to still be in office. But yes, agreed.That would be the cap they delayed for a decade then planned for after they left office?

I think it falls in same bucket as the NI cuts TBH. Just more vandalism.

Care needs fixing though. It’s destroying poor councils, some spending upwards of three quarters of their budget on care alone. It’s devastating families and driving immigration. Sadly the best we’ve heard so far is another “commission”, so nothing.

fernandopartridge

Well-Known Member

Just spend the fucking money and stop worrying about fiscal rules, the whole debate is based on a false premiseThat would be the cap they delayed for a decade then planned for after they left office?

I think it falls in same bucket as the NI cuts TBH. Just more vandalism.

Care needs fixing though. It’s destroying poor councils, some spending upwards of three quarters of their budget on care alone. It’s devastating families and driving immigration. Sadly the best we’ve heard so far is another “commission”, so nothing.

Sent from my Pixel 7 using Tapatalk

Just spend the fucking money and stop worrying about fiscal rules, the whole debate is based on a false premise

Sent from my Pixel 7 using Tapatalk

Depends what your false premise is

As explained before, the markets will dictate the cost of borrowing, if they don’t consider the spending/tax proposals are sensible we will have to pay more in interest to fund the deficit.

If you’re borrowing costs and deficit increases you have to print more money, if you print more, you debase the currency ie everyone gets less for their pound

If it’s borrowing to invest I think it will be accepted/fine, if it’s borrowing to cover an increasing day to day running cost deficit, borrowing costs will rise and the situation snowballs from there ie without sufficient growth the cost of servicing government debt keeps increasing as a percentage of gdp…which leads to more printing…and around we go

fernandopartridge

Well-Known Member

The markets do not dictate anything - the government chooses to sell them bonds, it does not need to. It can set the rate and if they don't want to buy them, they can go elsewhere for the rock solid government backed investment denominated in £ - where they going for it?

The markets do not dictate anything - the government chooses to sell them bonds, it does not need to. It can set the rate and if they don't want to buy them, they can go elsewhere for the rock solid government backed investment denominated in £ - where they going for it?

Where do they go ? You have to print money

Of course the markets dictate the borrowing rates of governments otherwise everyone would borrow at the same rate

fernandopartridge

Well-Known Member

Yeah, saw it last week and I agree with the overriding sentiment ie that Reeves shouldn’t allow the markets to dictate policy but I believe the article is really talking about investment/growth spending

‘Such plans will never be welcomed by the bond market. This is partly because more public investment is likely to mean a greater supply of gilts. But it is mostly because more investment will boost economic growth. This is anathema to bond investors. Paradoxically, such an acceleration is exactly what Britain needs if it is to move on to the path to long-term fiscal sustainability — a cause that they like to champion.’

I want us to borrow to invest, if we can’t improve growth and productivity we’re fucked. My biggest concern about the budget currently is that the focus on growth will be watered down and some policies may discourage investment. However i was saying you can’t just spend whatever you want and if the day to day running cost deficit is not seen to be controlled we will end up paying a lot more to fund the deficit and we’d ultimately have to print more…which debases currency etc etc

ultimately it will come down to how well the government spends ‘our’ money

shmmeee

Well-Known Member

Yeah, saw it last week and I agree with the overriding sentiment ie that Reeves shouldn’t allow the markets to dictate policy but I believe the article is really talking about investment/growth spending

‘Such plans will never be welcomed by the bond market. This is partly because more public investment is likely to mean a greater supply of gilts. But it is mostly because more investment will boost economic growth. This is anathema to bond investors. Paradoxically, such an acceleration is exactly what Britain needs if it is to move on to the path to long-term fiscal sustainability — a cause that they like to champion.’

I want us to borrow to invest, if we can’t improve growth and productivity we’re fucked. My biggest concern about the budget currently is that the focus on growth will be watered down and some policies may discourage investment. However i was saying you can’t just spend whatever you want and if the day to day running cost deficit is not seen to be controlled we will end up paying a lot more to fund the deficit and we’d ultimately have to print more…which debases currency etc etc

ultimately it will come down to how well the government spends ‘our’ money

Im really worried they think they can fix this with tinkering around the edges. Planning reform so far has been a bit of a damp squib, some good stuff but nothing truly radical, I worry the investment strategy will be the same and at best we’ll get a load of overpriced PFI projects.

MalcSB

Well-Known Member

Is the bond market what screwed Trussenomics?Yeah, saw it last week and I agree with the overriding sentiment ie that Reeves shouldn’t allow the markets to dictate policy but I believe the article is really talking about investment/growth spending

‘Such plans will never be welcomed by the bond market. This is partly because more public investment is likely to mean a greater supply of gilts. But it is mostly because more investment will boost economic growth. This is anathema to bond investors. Paradoxically, such an acceleration is exactly what Britain needs if it is to move on to the path to long-term fiscal sustainability — a cause that they like to champion.’

I want us to borrow to invest, if we can’t improve growth and productivity we’re fucked. My biggest concern about the budget currently is that the focus on growth will be watered down and some policies may discourage investment. However i was saying you can’t just spend whatever you want and if the day to day running cost deficit is not seen to be controlled we will end up paying a lot more to fund the deficit and we’d ultimately have to print more…which debases currency etc etc

ultimately it will come down to how well the government spends ‘our’ money

shmmeee

Well-Known Member

Is the bond market what screwed Trussenomics?

Id argue massive unfunded ongoing commitments screwed Truss, pinning it all on getting growth or bust. The left equivalent would be massive pay rises to public sector staff above inflation or market demand or creation of the national care service.

If Reeves does what she’s been claiming to want to do it’s capital borrowing so at least isn’t promising more spending in perpetuity and people are generally more aligned that what’s holding Britain back is infrastructure not the tax system so growth more likely.

That would be my hope anyway. Markets not always the most rational tho.

fernandopartridge

Well-Known Member

Is the bond market what screwed Trussenomics?

It has to be looked at in context, inflation was at 10% already by the time of that budget and Truss was at the same time underwriting the energy suppliers who represented a core underpinning driver. She also failed to engage with the bodies who manage the other implications of increased government spending.

Is the bond market what screwed Trussenomics?

Yeah, as FP mentioned though, various things at play including her ignoring trusted institutions/bodies (edit - meant OBR) said at the time that while I/we all thought Truss was a bit of a nutter (she is), the power/control of the markets and influence of unappointed institutions over policy should be a cause for concern for all, whoever people support, as to some extent, they seemingly tie the hands of democratically elected governments.

Ive no doubt it’s at least part of the reason why Reeves appears overly/too cautious in her approach.

Ultimately a lot of the stuff is still subjective ie what will lead to further growth and investment, how much etc. spending plans are also tied to economic forecasts and as we’ve seen in recent years a lot have been way off (BoE and others consistently shambolic !)

Last edited:

Earlsdon_Skyblue1

Well-Known Member

From the same woman who said Chris Kaba was a fine young man.

How have we got so many idiots representing us? This whole thing on reparations is utterly ridiculous.

How have we got so many idiots representing us? This whole thing on reparations is utterly ridiculous.

MalcSB

Well-Known Member

From the same woman who said Chris Kaba was a fine young man.

How have we got so many idiots representing us? This whole thing on reparations is utterly ridiculous.

Does it really matter if the Commonwealth crumbles? Let it.